Financial Fortitude: Smart Money Moves for the New Year

Introduction: Let us begin by decoding the title, fortitude. Fortitude means strength, so the title translates to “how to achieve financial strength.” The first of January brings along many resolutions among people, going to the gym, learning a new language and one of the most important ones is to be rich and financially independent.

To achieve financial freedom, one needs to begin by understanding the basics of money and the many ways of making it. Most people earn money through their occupations, vocations, lending money for interest and investing saved money for returns. Once the penny is in the bank, it is time to compound it and accumulate more. Let’s take a look at how to gain financial strength step by step. Firstly, why financial freedom is necessary? Financial stability is an important achievement in one’s life. It provides a sense of security and enables one to meet his needs and build a better future.

Table of Contents

Jot Down Financial Goals:

The fundamental understanding of saving, investing, functioning of markets must be obtained. Just like long term goals in life, one must also write down the long-term financial goals, break them down into five-year goals, yearly goals and then start making the necessary plans. The goal can be a retirement plan, higher education abroad, wedding, or even a world tour, all of them can be achieved via proper planning.

Budgeting Rule:

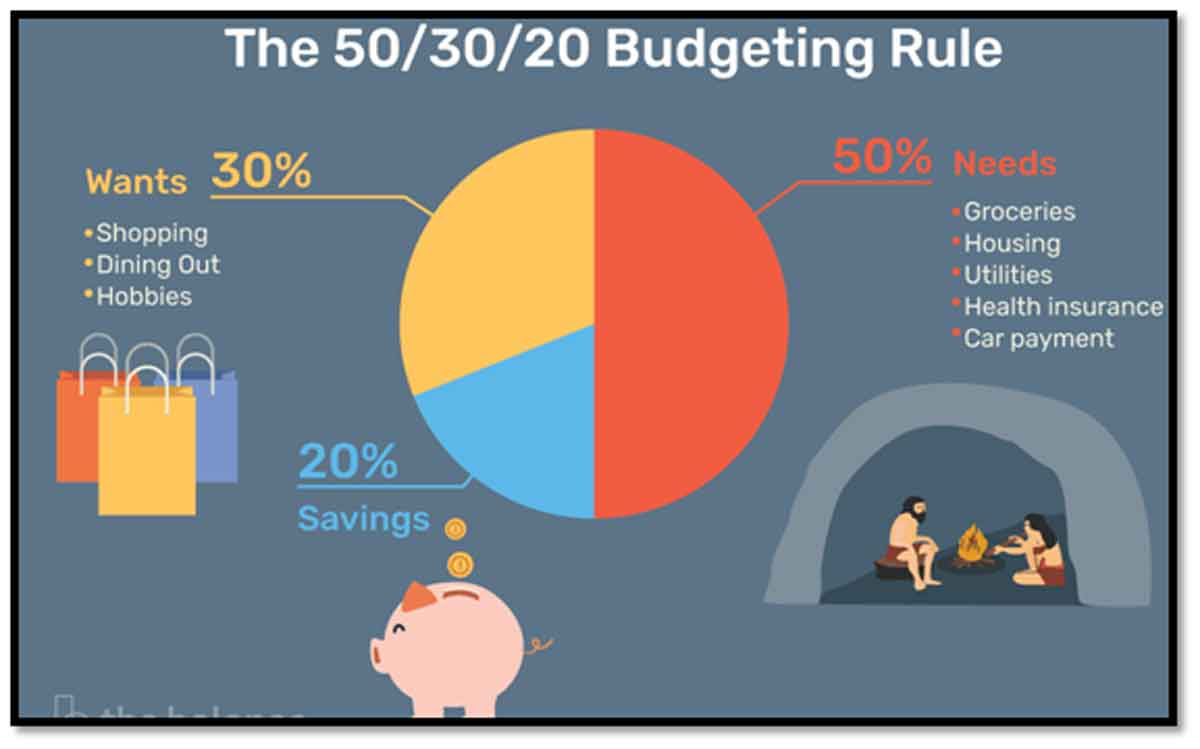

A wise man once said, the best way to respect money is to track it. After working for long hours in office, the salary gets credited at the end of the month, a time of reward and celebration to all employees. A necessary step everyone must follow here is to budget his expenses and needs for the coming month. The principle of “Save first, spend second” must be consciously implemented. The ratio of saving to spending may vary from person to person but a common practice is to follow the 50/30/20 rule.

According to the said rule, 50% of post-tax pay check is to meet the daily needs, 30% is for wants and 20% is to save and repay the debts. In the recent times many apps are available in the market which can be used to budget and analyse the expenses, and one must sincerely understand the needs of oneself and the family and prepare an appropriate budget. Consistency is key when comes to budgeting, updating, and tracking the expenses is as essential as budgeting. It is recommended to be done on a daily basis. As the economic conditions and personal situations change, the financial plans must be reviewed once in a while and adjusted accordingly.

Emergency Fund and Debts:

The next important thing is to be prepared for a rainy day, that is, to prepare an emergency fund. A certain portion of the savings as mentioned above can be earmarked for contingent situations. From the olden times, it has been advised to minimize or have no debt at all, so regular repayment of any debt can pave way for more financial freedom. Taking a house loan after proper analysis of one’s income and repayment capabilities is acceptable but taking a personal loan to make an impulse purchase of expensive clothing or accessory may be detrimental to achieving one’s financial freedom.

Investments:

The most important concept of financial freedom is to generate more money from the existing wealth. That is the concept of investing. To understand, the easiest example would be fixed deposits. Most of the people, have a fixed deposit earmarked for their needs. A particular amount is invested under a desired fixed deposit scheme, and say, after five or ten years, the principal and the interest are returned to the investor.

Fixed deposits are one of the many ways of investing. Investing in jewellery, real estate, shares and debentures are the others. Insurance is another investment, which not only offers a return on investment but also serves as an emergency plan, thus ticking off two conditions. By investing, one creates assets. When a share is purchased, it is an asset that generates dividend income.

When a house is purchased, it has capacity to generate rental income. The goal is to create assets, which by definition have the ability to generate money. Markets, interest rates, inflation, Finance Minister’s budget and its effect on the common man’s earnings might be a complex task to understand, and in such cases, it is advised to consult a financial advisor. Many Chartered Accountants, banks and asset managers are available to make the saving and investing decisions easy to the public. Free and accessible educational content provided by individuals, and institutions are also available to enrich the common man with financial knowledge.

Wise Planning:

While all the focus till now has been on saving and investing, it is to be noted that the present goals and wishes should also be considered. One should not forget to have fun and live a comfortable life; it is just important to be planned the money wisely. Small steps go a far way, shifting to energy efficient appliances at home, taking the public transport to commute, making use of discounts, loyalty points and cutting off unnecessary expenses, when followed throughout the year can actually save a huge amount of money.

Conclusion:

Staying updated with the economic situation around the home and the world, diligently following these steps and implementing one’s financial plans can definitely help achieve financial freedom both in the short and long term. It is also to be remembered that it is never too early nor too late to start financial planning and implementation, so grab your papers, pens and calculators and start achieving and fulfilling your New Year resolutions and your financial fortitude.