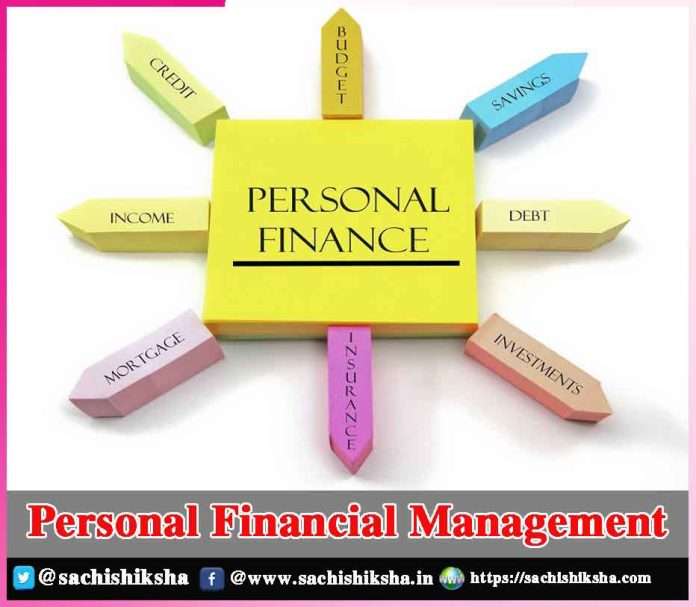

Personal Financial Management

Introduction: What is finance? Money is a component of finance because it’s what we use to buy and sell goods. Is that solely related to money? Handling finances is a task necessary for starting or maintaining a business, a family, etc. We are not accustomed to managing finances because we were never taught how to handle money.We are only permitted to handle money once we have begun to earn it.

However, we first struggled with handling money. Either we overspend or, even if we don’t, we don’t allocate enough money to the needs. As a result, we are making it problematic. Because we don’t have a saving habit, we occasionally find ourselves unable to cover an emergency expense. So, understanding how to manage finances is essential.

Also Read:

- Financial Challenges for People with Disability

- Challenges in Parenting in 21st Century

- Importance of Old People in a Family

- Money Management for Children

- Personal Financial Planning

Table of Contents

Financial Management Practices in Indian households:

How was it possible for her to pull it off? Have any of us ever wondered about it? She might be keeping a small secret that she divides the money into categories based on needs, then uses the remaining funds for other purposes. Planning your finances is really important. We could see that each of our mothers will set aside some cash.That is the tool that saves our entire family in a pinch. She also instills in her kids the value of saving money.

Crucial Elements of Money Management:

Classify the Income:

We must first classify the income. It would be preferable to write everything down. Put expenses, savings, and assets in a table. Rent, bills that need to be paid, groceries, medications, petrol, meals, travel, and other expenses, depending on the individual, can all be listed in the expense column. Prioritizing whatever we list in the expense column is important. As a result of the prioritization, we should have dealt with urgent and crucial expenses first before analyzing the remaining ones. If something egregious happens, trim it down and fix it. Proceed to the savings column next.

Here, it is advisable to subdivide savings into petty savings, savings for others, savings for unforeseen medical expenses, and savings for personal use. We should have some money set up in our own savings account for our own purposes. Everyone benefits from this, and it even helps those around them. Taking care of family comes before saving for others. Life is unpredictable. Our kids urge us to participate in extracurricular activities with them, to buy them presents for their friends’ birthdays, or to purchase them something for a relative. We will benefit from this saving part. Petty saving is nothing more than what we have been doing from childhood, which is putting very little cash in our piggy banks.

Note the Expenses & Savings:

Writing down expenses and savings is insufficient. We must continuously monitor it. Knowing how much we are spending, which expenses we can reduce, how much we can save each month, and other information is made possible by keeping track of our expenses and savings. There are numerous applications that make it simple for us to do so. Through those applications, we learned how much money we spend on things like food, travel, shopping, etc. This information helps us identify wasteful spending so that we may reduce it in the following month. Excel sheets are another tool for tracking it.

Three Common Advice:

Being certain of three things is the common advice for avoiding personal financial catastrophe. 1. Creating an emergency fund 2. Budgeting and spending tracking 3. Paying off debt. We need to confirm that it should always be stored in accordance with the first point. It shouldn’t be dropped from the list of necessities. Regardless of anything, we should block 6 months’ worth of amounts here. By doing this, it will be helpful in those unemployed days if something happens and we are unable to earn for a few days.

The second point has previously been covered in great detail. “50 30 20 concept” is the second point in the rules to follow. i.e., we should spend 50% of our income on necessities, 30% on wants, and 20% on savings or loans. The rule “70 20 10” is another. 30% goes towards saving, 20% towards living costs, and 10% goes towards debt. Let’s go on to the third. We shouldn’t trip over our bills. The “20 4 10 notion” is one excellent way to reduce debt. If you want to buy a car, you should be prepared to put down 20% of the price and be able to pay back the loan in full within four years and therefore the monthly installments cannot be more than 10% of the monthly revenue.

Conclusion: By doing this, we may better manage our finances and see changes in our way of living. Managing everything in life, especially money, is crucial. If we handle our money wisely, it will reward us by helping us live a happy life.